ERC-20 tokens, frequently encountered by digital asset enthusiasts, represent a crucial segment of prominent cryptocurrencies.

What exactly does ERC-20 signify, and what are the standards that define these tokens? This exploration aims to uncover the nuances of these widely used digital asset terms.

Fundamentals of Token Standards

These standards function as smart contracts, forming the foundation for creating, issuing, and placing various operational tokens on the blockchain. Although numerous blockchain platforms currently offer decentralized application (Dapp) creation capabilities, this analysis focuses solely on Ethereum.

Among Ethereum’s notable standards like ERC-721, ERC-777, and ERC-1155, ERC-20 remains the most widespread. Each standard serves specific purposes, fulfilling various Dapp requirements, from asset transfer to ownership rights.

Decoding ERC-20 Tokens

While some elements are mandatory, others, such as the name, symbol, and decimal places, remain optional, providing flexibility.

Examples of ERC-20 include:

- Augur (REP);

- Basic Attention Token (BAT);

- Maker (MKR);

- USD Coin (USDC);

- OmiseGO (OMG).

These tokens adhere to certain rules that ensure optimal functioning on the Ethereum blockchain. Their launch follows community approval, establishing rules like total supply definition, wallet balances, transfer capabilities, and transaction approvals.

Can You Mine ERC-20 Tokens?

Unlike Ethereum and its native coins which can be mined, ERC-20 cannot be mined. Token creation involves planned offerings, where users exchange Ethereum for new ERC-20 tokens. Although developers can issue new coins via smart contracts, unrestricted issuance can diminish user trust and devalue tokens, highlighting the necessity of their scarcity.

ERC-20 tokens, prevalent in Ethereum’s blockchain ecosystem, are extensively utilized in various blockchain activities like Initial Coin Offerings (ICOs), decentralized apps (dApps), and asset tokenization.

Below are the merits and challenges associated with ERC-20:

Advantages:

- Broad Compatibility: ERC-20 align seamlessly with services and apps built on the Ethereum blockchain, ensuring effortless integration across diverse platforms, wallets, and trading platforms;

- Unified Standards: ERC-20 provides a consistent rule set for Ethereum-based tokens, offering uniformity. This benefits developers by easing the creation of compatible new coins;

- Enhanced Liquidity: Operating on the Ethereum blockchain opens ERC-20 to numerous decentralized and centralized trading venues, thus facilitating easier trades and increased liquidity;

- Smart Contract Advantages: These coins benefit from Ethereum’s smart contract technology, enabling sophisticated functionalities like automated transactions and programmable digital currency.

The well-established nature of Ethereum as a blockchain platform contributes to a solid foundation for ERC-20 tokens, backed by a strong community and developer ecosystem.

Challenges:

Despite their pivotal role in shaping digital asset creation and exchange, ERC-20 encounter specific hurdles:

- Scalability Hurdles: Ethereum’s scalability struggles result in elevated gas fees and network overloads, especially during high-use periods, impacting the practicality and financial efficiency of ERC-20;

- Security Concerns: Although ERC-20 tokens inherit Ethereum’s security protocols, smart contract vulnerabilities or coding mistakes can expose them to potential security breaches or misuses;

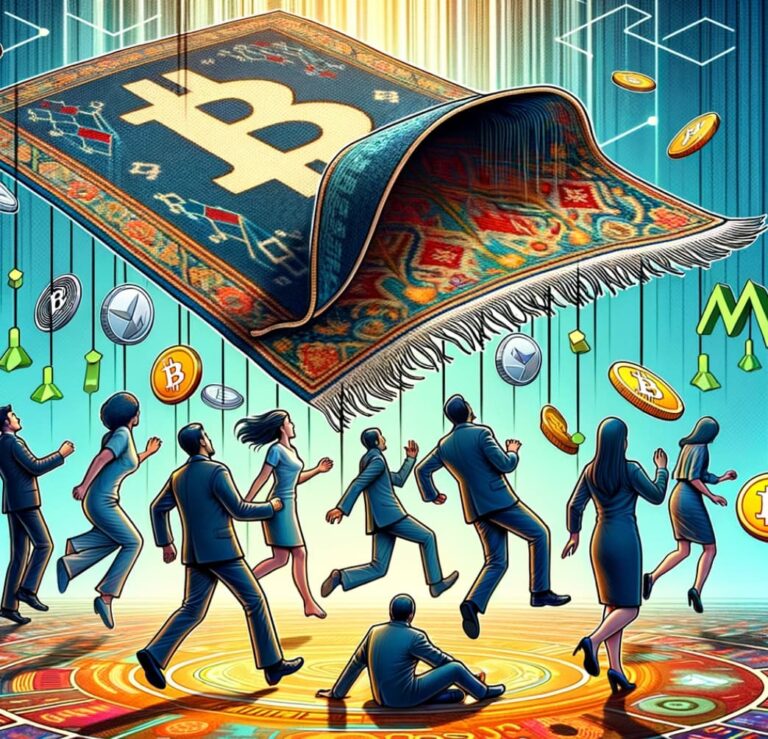

- Dependency on Ethereum: The functionality of ERC-20 is tightly linked to Ethereum’s network health. Any alterations or disruptions in Ethereum can significantly affect these tokens;

- Regulatory Ambiguity: The evolving legal landscape around digital currencies and tokens brings uncertainties. Compliance demands may sway the issuance and trading of ERC-20, posing risks to projects and investors;

- Fixed Code Post-Deployment: Once an ERC-20 contract is deployed, its code is unchangeable. Any arising issues or updates might necessitate a new contract deployment, which could disrupt operations or pose migration challenges.

ERC-20 tokens, while contributing substantially to the cryptocurrency ecosystem’s growth and fostering innovation, grapple with scalability, security, and compliance issues.

Diverse ERC Token Standards in Ethereum

Ethereum’s ecosystem has expanded to include various ERC token standards, each catering to specific functional needs and use cases. Here’s an overview of other notable ERC token standards:

- ERC-721 (Non-Fungible (NFTs)): This standard is utilized for crafting unique tokens with distinct characteristics, ideal for denoting ownership or authenticity of unique digital assets, like artworks or gaming items;

- ERC-1155 (Multi-Standard): Merging aspects of ERC-20 and ERC-721, ERC-1155 facilitates the creation of both fungible and non-fungible tokens under one contract, streamlining token management in digital assets and gaming;

- ERC-777 (Advanced Standard): This improved version of ERC-20, ERC-777, introduces capabilities like direct sending to smart contracts, comprehensive approvals, and custom behavior hooks, enhancing user interactions and experiences;

- ERC-1400 (Security Standard): Tailored for security tokens, ERC-1400 integrates compliance features addressing investor permissions and ownership rules, representing real-world assets like stocks or real estate;

- ERC-621 (Supply Modifiable): Different from ERC-20’s fixed supply, ERC-621 allows alteration in quantity, adding flexibility for projects needing supply adjustments.

Each ERC standard within the Ethereum ecosystem provides developers and projects with options to select a standard that aligns best with their functional requirements and application scenarios.

Emerging Trends and Future Potential of ERC-20 Tokens

As the landscape of digital assets evolves, ERC-20 stands at the forefront of innovation and adaptation. Here, we explore emerging trends and the future potential of these tokens:

- Integration with DeFi Platforms: ERC-20 tokens are increasingly becoming integral to the burgeoning decentralized finance (DeFi) sector. Their compatibility with Ethereum’s blockchain enables seamless incorporation into DeFi protocols for lending, borrowing, and yield farming. This integration signifies a transformative step towards more open and accessible financial systems;

- Cross-Chain Compatibility and Layer 2 Solutions: With the advancement of blockchain technology, there’s a growing trend towards developing cross-chain solutions and Layer 2 scaling options. ERC-20 are poised to benefit significantly from these developments. Enhancing interoperability between different blockchain networks and reducing transaction fees and times will further increase the utility and reach of these coins;

- Tokenization of Real-World Assets: The future of ERC-20 is not limited to digital realms. There’s an increasing interest in tokenizing real-world assets like real estate, artwork, and commodities. This trend could revolutionize how we invest in, trade, and manage physical assets, providing more liquidity and accessibility to diverse markets;

- Regulatory Developments and Institutional Adoption: As regulatory clarity improves, ERC-20 are likely to see increased adoption by institutional investors. This could lead to more professionally managed funds and financial products based on these coins, providing mainstream credibility and stability to the digital asset market;

- Technological Advancements and Upgrades: The upcoming Ethereum 2.0 upgrade promises to address many of the scalability and efficiency issues currently faced by the network. This upgrade is expected to significantly benefit ERC-20 by reducing transaction costs and increasing throughput, making them more viable for widespread use.

Impact of ERC-20 Tokens on the Global Blockchain Ecosystem

The introduction and adoption of ERC-20 tokens have had a profound impact on the global blockchain ecosystem:

- Standardization in Creation: ERC-20 have set a standard in the blockchain space for creating and issuing new coins. This standardization has simplified the process for developers and fostered a more accessible environment for innovation;

- Growth of Decentralized Applications (dApps): ERC-20 tokens have been instrumental in the growth of dApps. Their flexibility and compatibility with Ethereum’s smart contract functionality have enabled developers to create a wide array of decentralized applications, ranging from gaming to finance.

- Contribution to Market Diversity and Complexity: The proliferation of ERC-20 tokens has contributed to the diversity and complexity of the cryptocurrency market. It has allowed for the emergence of a multitude of digital assets, each serving different purposes and catering to various niches within the blockchain community;

- Facilitating Crowd Funding and ICOs: ERC-20 tokens have played a significant role in facilitating crowdfunding through Initial Coin Offerings (ICOs). They have provided a platform for startups and projects to raise capital directly from a global pool of investors, democratizing access to funding;

- Promoting Blockchain Education and Engagement: The widespread use of ERC-20 tokens has also had an educational impact, encouraging more individuals and organizations to learn about blockchain technology and participate in the digital asset economy. This increased engagement is crucial for the long-term growth and sustainability of the blockchain ecosystem.

In summary, ERC-20 tokens have not only expanded the scope of blockchain technology but have also paved the way for future innovations and transformations within the digital asset landscape.

Conclusion

Grasping the concept of ERC-20 tokens entails an in-depth understanding of Ethereum’s fundamental functionalities and their role in the crypto landscape. As the cryptocurrency domain evolves, the adaptability and versatility of token standards like ERC-20 continue to be pivotal in shaping the future of decentralized apps and digital assets. ERC standards, supporting both interchangeable and unique asset representations, are at the forefront of blockchain innovation.