In the contemporary financial world, innovations, especially those involving money like Bitcoin, often prompt people to hastily categorize them, sometimes leading to misconceptions. One such misconception is the comparison of Bitcoin to a Ponzi Scheme. This detailed analysis aims to clarify why Bitcoin, contrary to some beliefs, does not align with the characteristics of a Ponzi Scheme.

What Constitutes a Ponzi Scheme?

Understanding why Bitcoin is not a Ponzi Scheme necessitates a thorough grasp of what a Ponzi Scheme entails. A Ponzi Scheme is an investment fraud promising high returns with minimal risk to investors. The scheme operates by using the capital of new investors to pay earlier investors, creating an illusion of profitability. The orchestrator, often posing as a savvy ‘portfolio manager’, siphons off a portion of these funds. The scheme is sustainable only as long as there is a steady flow of new investors. Once the influx of new capital dries up, the scheme collapses.

The concept of Ponzi Schemes is not new. Although officially named after Charles Ponzi in the 1920s, who famously duped thousands, the basic structure of such scams was mentioned in literature in the 1800s. These schemes are illegal and punishable in many countries under financial fraud laws.

Dissecting the Myth: The Distinct Nature of Bitcoin

Bitcoin’s emergence as a decentralized digital asset marks a significant departure from traditional financial systems. Its operation through blockchain technology offers an unprecedented level of transparency and openness. In a blockchain, every transaction is recorded on a public ledger, accessible for verification by anyone, a stark contrast to the opaque dealings of Ponzi Schemes.

- Transparency and Decentralization. The blockchain technology underpinning Bitcoin is a decentralized network of computers, where each transaction is recorded in a ‘block’ and linked to a ‘chain’ of previous transactions. This transparency ensures that all activities are open for scrutiny, making it fundamentally different from the secretive and misleading operations of Ponzi Schemes;

- The Role of Volatility in Debunking Myths. Bitcoin is known for its price volatility, a trait not found in Ponzi Schemes. In Ponzi Schemes, returns are typically consistent and unrealistically stable. In contrast, Bitcoin’s price can swing dramatically, reflecting its true market-driven nature. This volatility is partly due to its relatively new status in financial markets and various external factors influencing its demand and supply;

- Growth Patterns in Bitcoin. Analyzing Bitcoin’s growth pattern reveals a cyclical trend, often linked to its halving events. These events, occurring approximately every four years, reduce the reward for mining new blocks, thereby slowing down the rate of new Bitcoin creation. This scarcity often leads to an increase in Bitcoin’s value. This predictable, systematic approach is fundamentally different from the erratic and unsustainable growth of Ponzi Schemes.

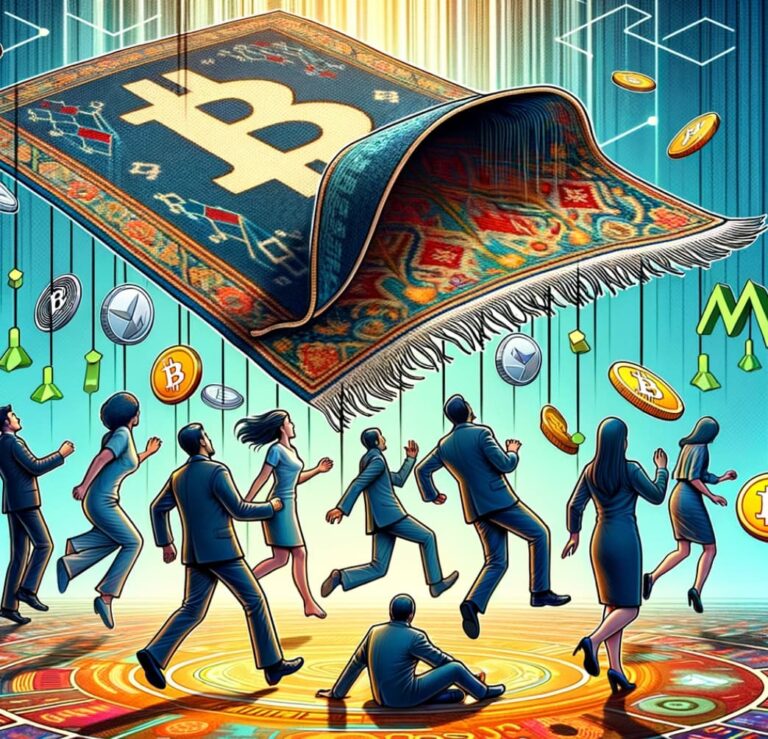

Navigating the Cryptocurrency Landscape: How to Avoid Ponzi Schemes

While cryptocurrencies themselves, including Bitcoin, are not Ponzi Schemes, it is crucial for investors to remain vigilant against schemes that misuse cryptocurrencies to lure unsuspecting investors.

Tips for Safe Cryptocurrency Investment

- Research Thoroughly: Before investing, conduct extensive research on the cryptocurrency and the platform you choose to invest in. Look for transparency, company history, and reviews;

- Use Reputable Platforms: Invest directly through established and reputable cryptocurrency platforms. These platforms provide secure digital wallets and real-time trading options;

- Beware of Unrealistic Promises: Be cautious of any scheme that promises guaranteed high returns with little to no risk, especially if they require recruiting more participants;

- Stay Informed: Keep up-to-date with cryptocurrency news and regulatory changes in the crypto space.

The Role of Education in Crypto Investments

Educating oneself about cryptocurrencies and blockchain technology is crucial. Understanding how these technologies work provides a clear picture of their legitimacy and helps distinguish them from fraudulent schemes.

The Future of Bitcoin and Cryptocurrencies

As the world becomes more digitally interconnected, cryptocurrencies like Bitcoin are likely to play a significant role in the financial landscape. Their decentralized nature, coupled with blockchain technology, offers an alternative to traditional banking and financial systems. However, as with any emerging technology, there are risks involved. The volatility and regulatory uncertainties surrounding cryptocurrencies are factors that investors should consider.

The Evolution of Bitcoin

Since its inception in 2009, Bitcoin has evolved from a niche digital currency to a widely recognized financial asset. Its acceptance by businesses and increasing interest from institutional investors underscore its growing legitimacy and potential as a long-term investment.

Regulatory Landscape

Regulations around cryptocurrencies are evolving. Governments and financial institutions are exploring ways to integrate these digital assets into the existing financial system while ensuring investor protection and financial stability. This evolving regulatory landscape will likely shape the future of Bitcoin and other cryptocurrencies.

Conclusion

Understanding the fundamental differences between Bitcoin and Ponzi Schemes is essential for anyone navigating the modern financial ecosystem. Bitcoin’s decentralized nature, transparent blockchain technology, market-driven volatility, and growth patterns differentiate it significantly from Ponzi Schemes. As the cryptocurrency landscape continues to evolve, informed and cautious investment strategies will be key to leveraging the potential of digital currencies like Bitcoin while avoiding the pitfalls of fraudulent schemes.