Synthetix stands as a notable entity in the decentralized finance (DeFi) landscape, introducing a novel method of tracking and deriving value from underlying synthetic assets. This approach allows users to gain returns without the necessity of directly holding the actual asset.

The Evolution of Synthetix

Initially launched as Havven in 2017, Synthetix underwent a strategic rebranding in 2018. Since then, it has established a formidable presence within the cryptocurrency and DeFi sectors.

How Synthetix Transforms DeFi

Synthetix distinguishes itself as a decentralized protocol for asset protection and derivatives trading. Users can create, hold, and trade synthetic derivatives spanning various asset categories, such as fiat currencies, commodities, stocks, and cryptocurrencies. This mechanism enables efficient exposure to diverse assets without the necessity of owning the underlying securities or depending on centralized intermediaries.

The Synthetix Protocol Mechanism

At its core, Synthetix uses two distinct cryptocurrencies: the native Synthetix Network Token (SNX) and synths, digital assets that replicate the value of real-world assets. Users stake SNX to mint synths, with the value of staked SNX needing to maintain a minimum threshold relative to the value of the synths issued.

Synthetix Network Token (SNX) Explained

The SNX token, an ERC-20 token, plays a crucial role within the Synthetix ecosystem, serving as collateral for minting synthetic assets. These tokens are locked in smart contracts during the creation of synths and are integral to the staking mechanism, offering rewards generated from transaction fees on the Synthetix Exchange.

Acquiring Synthetix (SNX) Tokens

For individuals interested in incorporating SNX tokens into their cryptocurrency portfolio, various platforms, such as the Tap app, provide a secure and user-friendly interface for trading these tokens. The process involves straightforward account setup and verification, enabling easy access to buy, sell, or trade SNX tokens.

Key Features of Synthetix (SNX)

- Decentralized Finance Innovation: Synthetix facilitates seamless access to a variety of asset classes in a decentralized manner, a significant advancement in DeFi;

- Synthetic Asset Creation: Users can mint synthetic versions of real-world assets, offering exposure without requiring direct ownership;

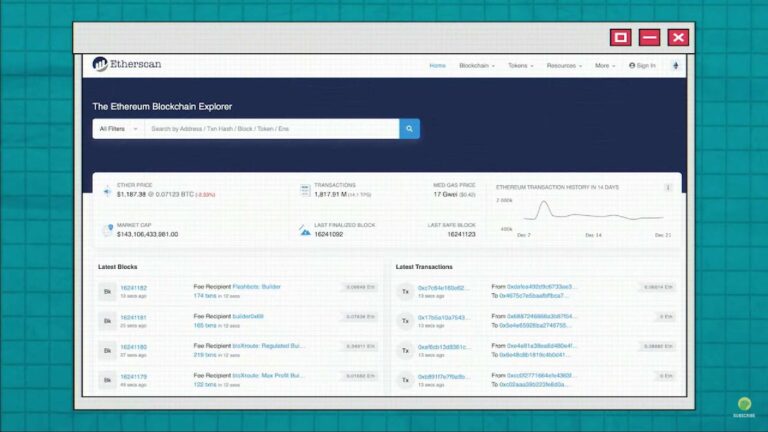

- Robust Security Protocol: Utilizing Ethereum’s blockchain, Synthetix ensures secure and transparent transactions;

- Diverse Asset Classes: Ranging from fiat currencies to cryptocurrencies, Synthetix covers a broad spectrum of assets.

Comparative Analysis: Synthetix vs. Other DeFi Platforms

| Feature | Synthetix (SNX) | Other DeFi Platforms |

|---|---|---|

| Asset Types | Broad (fiat, crypto, etc.) | Often Limited |

| Decentralization | High | Variable |

| User Accessibility | User-friendly | Varies |

| Security | Ethereum-based | Diverse |

| Innovation in Finance | Synthetic Assets | Traditional Assets |

Understanding ‘HODL’ in the Cryptocurrency Context

As we explore the intricacies of the Synthetix platform and its role in the decentralized finance landscape, it’s essential to also understand key terminologies and strategies within the crypto world, such as ‘HODL.’

HODL: A Strategic Approach in Crypto Investing

- Origin: Stemming from a typo in a Bitcoin forum, ‘HODL’ has become a popular term in the crypto community, symbolizing a long-term investment strategy;

- Meaning: Rather than engaging in frequent trading, HODLing implies holding onto cryptocurrency investments through market fluctuations, aiming for long-term value appreciation;

- Philosophy: This approach reflects a deep belief in the long-term potential of cryptocurrencies and blockchain technology, beyond short-term market trends.

Incorporating the HODL strategy into investment decisions, especially with innovative platforms like Synthetix, can align with long-term perspectives and beliefs in the transformative power of digital assets and decentralized finance.

Conclusion

In conclusion, Synthetix (SNX) emerges as a pivotal player in the DeFi ecosystem, introducing innovative mechanisms for trading and investing in synthetic assets. Through its unique approach, it enables access to a broad range of asset classes, empowering users with decentralized and flexible investment options. The platform’s evolution, marked by strategic advancements and a strong focus on user accessibility, positions it at the forefront of the DeFi revolution.

Furthermore, understanding concepts like ‘HODL’ within the cryptocurrency realm enriches the perspective of investors, intertwining investment strategies with technological innovations like Synthetix. As the DeFi sector continues to evolve, platforms like Synthetix play a crucial role in shaping the future of finance, where decentralization, security, and accessibility are key.

Ultimately, the journey of Synthetix and the broader adoption of DeFi practices underscore a significant shift in financial paradigms, driven by blockchain technology and innovative platforms that democratize access to diverse financial instruments. The fusion of these elements suggests a promising and dynamic future for the world of finance.