1inch emerges as an avant-garde cryptocurrency trading instrument tailored for traders, granting them swift access to competitive pricing on decentralized exchanges (DEXs) through its groundbreaking 1INCH token, which endows token holders with both utility and governance roles.

What exactly constitutes the 1inch network?

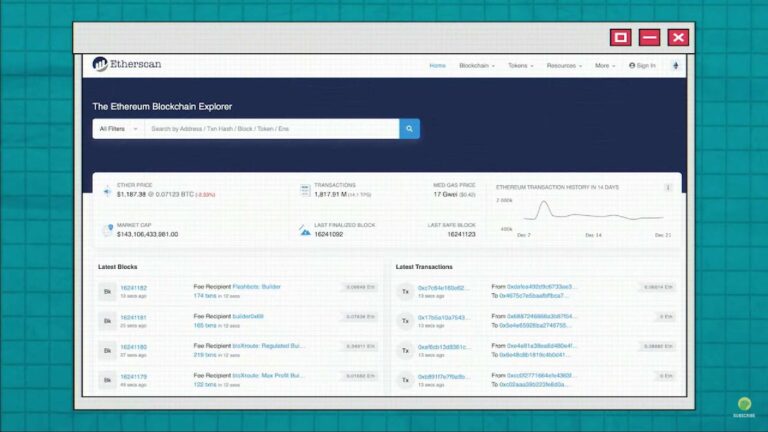

The 1inch network stands as a decentralized exchange aggregator, serving as a guiding hand to crypto traders in their quest for optimal prices and minimal fees within the realm of decentralized finance (DeFi) within the cryptocurrency domain.

Decentralized exchanges employ self-executing smart contracts to facilitate transactions between purchasers and vendors, harnessing a non-custodial infrastructure. This, in turn, ensures seamless transactions while upholding the paramount security of assets.

However, while these exchanges fortify security, they do not invariably bolster liquidity, thereby paving the way for a phenomenon termed ‘slippage.’ Slippage refers to the discordance between the anticipated trade price and the realized price upon execution. The 1inch protocol comes to the rescue, averting this issue and rectifying other market inefficacies by amalgamating trading activities from numerous markets while merging liquidity.

In its essence, the DeFi arena is notorious for its capricious price fluctuations and transaction costs concerning crypto assets, a quandary that 1inch adeptly resolves. Instead of obliging traders to laboriously amass and juxtapose prices across various DEXs, the 1inch network collates real-time pricing data, inclusive of gas fees, from a slew of premier exchanges, proffering this data to the trader. These exchanges encompass the likes of 0x, SushiSwap, Uniswap, and Kyber Network.

The network derives its impetus from the 1INCH token, an ERC-20 token endowed with governance rights and active participation in the network’s expansion. This token serves a dual purpose as a utility token and a governance token, empowering holders to exercise their franchise on pivotal protocol parameters.

Who stands as the progenitor of the 1inch platform?

The genesis of 1inch can be attributed to the visionaries Surjey Kunz and Anton Bukov, who embarked on this journey during the ETHGlobal New York hackathon in May 2019, all underpinned by the Ethereum blockchain. The duo had previously joined forces in hackathons, accruing accolades along the way.

Preceding this endeavor, Sergej Kunz possessed a trove of experience in the realms of programming and development. He assumed the role of a senior developer at Commerce Connector, contributed code to Herzog agency, helmed projects with Mimacom consultancy, and occupied roles in both DevOps and cybersecurity at Porsche.

With nearly two decades immersed in software development, a half-decade specializing in decentralized finance (DeFi), Anton Bukov evolved into a seasoned luminary, contributing to ventures such as gDAI.io and NEAR Protocol.

In August 2020, 1inch secured a formidable $2.8 million in funding, courtesy of Binance Labs, Galaxy Digital, and several other notable firms, subsequently augmenting this with an additional $12 million in December, drawing support from illustrious firms, including ParaFi Capital and Pantera Capital. A year later, 1inch attained a colossal $175 million in another funding round spearheaded by Amber Group.

How does the 1inch Protocol orchestrate its operations?

At its core, 1inch operates analogously to prevalent travel booking platforms, wherein the protocol aggregates and contrasts cryptocurrency prices and transaction fees from sundry decentralized exchanges. The platform harnesses three prominent protocols: the aggregation protocol, the liquidity protocol, and the limit order protocol.

The aggregation protocol, a calculus that takes gas fees into account

By embracing 1inch, traders are bestowed with the convenience of trading through a solitary platform, while concurrently being exposed to the most competitive trading fees and optimal prices from an array of DEXs. Their Pathfinder offering not only unearths the premier trading routes across diverse markets but also factors in gas fees. The aggregation protocol deftly incorporates gas fees when formulating the most advantageous price routes.

For instance, this intricate protocol can disassemble individual trades across multiple DEXs to secure the best market price. Unearthing the most efficient swapping routes might necessitate the conversion of a cryptocurrency into a stablecoin, followed by an exploration of the optimal cryptocurrency prices across myriad exchanges, taking into account nominal trading fees, before the original trade is executed. The complex backend routing processes are seamlessly handled by 1inch, facilitating the execution of a trade at the zenith of prices.

The liquidity protocol caters to liquidity providers

The platform’s liquidity protocol introduces a cutting-edge automated market maker (AMM), which not only extends lucrative prospects to liquidity providers but also erects a protective barrier against front-running attacks, a recurrent menace linked to liquidity pool trading.

The liquidity protocol permits users to accrue passive income by depositing their cryptocurrencies into the pertinent liquidity pools, in return for LP tokens. These LP tokens can either be staked or exchanged, while the cryptocurrencies ensconced in the liquidity pools can be utilized for transactions executed by liquidity providers engaging with the 1inch exchange, a decentralized exchange.

To partake in the liquidity protocol or the 1inch exchange, users merely need to tether their wallet and elect the liquidity pool (trading pair) they intend to supply liquidity to. Additionally, as the decentralized exchange aggregator refrains from storing any cryptocurrency assets on its servers, users are absolved from any withdrawal or deposit fees when availing themselves of the 1inch exchange services.

The limit order protocol for decentralized exchanges

Deemed one of the “most groundbreaking and versatile limit order swap opportunities in the realm of DeFi,” 1inch’s limit order protocol empowers traders to initiate more intricate, condition-based orders, thereby ensuring automatic safeguarding of profits at predetermined prices or the circumvention of losses.

In conjunction with the adaptable limit order functionality, the protocol extends a range of features, encompassing dynamic pricing, supplementary RFQ support, and galvanizing diverse implementations.

What role does the 1INCH token play?

The 1INCH token, an ERC-20 token, wears multiple hats as a utility and governance token within the platform. Beyond conventional functions like spending, transferring, holding, and staking, the 1inch token confers voting privileges upon token holders in determining the fate of proposed protocol amendments.

How can I procure the 1INCH token?

Users can seamlessly integrate the 1INCH token into their portfolio via the secure Tap app platform. This user-friendly process accommodates individuals with registered accounts, facilitating effortless trading experiences with both cryptocurrencies and fiat currency.

Immerse yourself in the expansive 1inch ecosystem by inaugurating an account and depositing your preferred wallet, subsequently executing a transaction to acquire the 1INCH token. These tokens can be safeguarded in the integrated wallet or wielded on the 1inch exchange platform or liquidity pools, all through uncomplicated transactions. To commence this journey, all that’s required is downloading the app and creating an account.

BitDAO

BitDAO stands as an innovative decentralized autonomous organization (DAO) that has garnered significant attention in the crypto space. It is dedicated to advancing the world of decentralized finance (DeFi) by providing a platform for collaborative decision-making and funding of promising DeFi projects. BitDAO leverages blockchain technology to create a decentralized and transparent ecosystem where participants have a say in the direction of DeFi initiatives.

Here are some key aspects of BitDAO:

- Decentralized Governance: BitDAO operates on a decentralized governance model, which means that decisions regarding project funding and development are made collectively by token holders. This ensures a fair and inclusive approach to managing DeFi projects;

- Funding DeFi Innovation: BitDAO’s primary mission is to support and fund innovative DeFi projects. It allocates resources to projects that have the potential to bring positive change to the DeFi ecosystem, fostering growth and sustainability;

- Transparent Operations: Transparency is a cornerstone of BitDAO’s operations. All decisions and transactions within the organization are recorded on the blockchain, ensuring accountability and openness;

- BIT Token: BitDAO has its native token called BIT, which serves as the governance token for the organization. BIT holders have the authority to vote on proposals and shape the future of BitDAO.

Conclusion

In summary, 1inch and BitDAO are trailblazing forces in the world of decentralized finance (DeFi). 1inch has redefined cryptocurrency trading with its efficient protocols, while BitDAO is empowering the community to fund and shape the future of DeFi projects. Together, they exemplify the boundless potential of blockchain technology, ushering in a transformative era in finance. Keep a close watch on these pioneers as they lead the charge into the exciting frontier of DeFi.