Trading in the volatile world of cryptocurrencies can be challenging, with fast-paced market movements and the continuous influx of new information. Understanding and managing the effects of Fear, Uncertainty, and Doubt (FUD) is critical to successful trading. This in-depth article aims to empower traders, both beginners and seasoned experts, to identify FUD in the blockchain ecosystem and effectively navigate through it.

The advent of Bitcoin in 2009 brought about a revolution in financial markets, giving birth to the ever-evolving landscape of cryptocurrencies. These markets, while presenting immense opportunities, have also been characterized by significant fluctuations. Indeed, the crypto world has faced numerous ebbs and flows since inception. It’s important to note that every bear phase has ultimately led to a bull run, signalling a resilient and growing market. However, during those challenging times, traders, regardless of their experience, often find it difficult to steer through the market turbulence, especially with the shadow of FUD looming large.

FUD, an acronym for Fear, Uncertainty, and Doubt, is a significant driving force behind decision-making in the crypto markets. These three elements can greatly influence investor behavior and market trends and can be leveraged by traders who lack ethical trading principles. However, before diving into strategies to recognize and manage FUD, let’s start by understanding what FUD truly means in the context of cryptocurrency trading.

Unmasking FUD in Crypto Trading

- Fear – Fear is an emotional reaction to perceived threats. In crypto trading, it can be triggered by myriad factors, like negative news about regulatory changes, technological failures, security breaches, or market crashes, causing traders to sell their holdings;

- Uncertainty – Uncertainty in crypto trading arises when there is a lack of concrete information about a particular asset or the market as a whole. It can cause investors to hesitate or postpone their investment decisions;

- Doubt – Doubt in the crypto world can be induced by misinformation or a lack of trust in the reliability of a cryptocurrency or the underlying technology.

By understanding these three elements, traders can learn to navigate the murky waters of FUD, making informed decisions and safeguarding their investments. The following sections will delve further into recognizing and mitigating FUD in crypto trading, providing practical tools and strategies for every crypto trader.

Understanding Fear, Uncertainty, and Doubt (FUD) in Cryptocurrency Trading

In the dynamic universe of cryptocurrencies, FUD denotes the elements of Fear, Uncertainty, and Doubt that can significantly impact market behavior. It is often a strategy deployed by individuals or entities seeking to influence the cryptocurrency market to their advantage. By spreading misleading or incomplete information, they attempt to incite panic or anxiety among traders, potentially prompting them to sell their assets precipitously.

Bitcoin, with its prominence in the crypto space, is a common target of FUD, but other popular currencies like Ethereum, Ripple, or Litecoin are not immune either. The propagation of FUD can trigger a chain reaction of sell-offs among investors, causing a domino effect that culminates in a considerable depreciation of the concerned cryptocurrency’s value.

In the vast lexicon of crypto trading, FUD is frequently contrasted with another acronym, FOMO, which stands for Fear Of Missing Out. As the name suggests, FOMO represents the apprehension traders feel about missing potential gains and prompts them to make hasty buying decisions. Essentially, while FUD is a tactic used to incite asset sell-offs, FOMO is leveraged to drive asset purchases.

The primary mediums for disseminating FUD are influential platforms, news media, or celebrity figures with substantial followings. A negative narrative or rumor about a certain asset on a trusted website, a condemning news report, or a popular figure expressing concerns can easily stoke the flames of FUD. It’s crucial to understand that such content is often crafted with the express intention of manipulating reader emotions to encourage certain trading behaviors.

It’s worth noting that FUD and FOMO aren’t peculiar to cryptocurrency trading alone. These manipulative tactics have their roots in traditional markets, including stocks and commodities. Over time, these terms have become ingrained in the trading vernacular and are recognized globally as market manipulation strategies.

Strategies to Navigate FUD in Crypto Trading

Now that we’ve understood what FUD means, let’s explore some strategies for identifying and dealing with it effectively:

- Stay Informed: Keep up with the latest news and developments in the crypto world. Use reliable sources and cross-verify information before making any trading decisions;

- Be Skeptical: Do not be easily swayed by alarming news or rumors. Always question the source and potential motives behind the information disseminated;

- Stay Calm and Rational: Making trading decisions fueled by fear or panic often leads to mistakes. Try to stay calm and rational, even in times of market instability;

- Diversify Investments: Diversifying your crypto portfolio can help mitigate the impact of FUD on your investments;

- Knowledge is Power: The more you understand about blockchain technology and cryptocurrencies, the less likely you are to be influenced by FUD.

By gaining a better understanding of FUD and how to navigate it, traders can protect their assets and make more informed decisions in the crypto world.

Recognizing FUD in Cryptocurrency Trading

The crypto community, while generally robust and supportive, isn’t immune to the infiltration by those with nefarious intentions. These entities can manipulate the market by disseminating falsehoods or misinterpretations of information, particularly about hotly-debated topics like regulatory changes or technological advancements.

Here’s how you can recognize FUD and protect yourself from its potential impacts:

Formulate a Clear Trading Objective

Possessing a clear, objective trading goal, complete with a timeline and milestones, can go a long way in maintaining focus amidst market volatility. Ask yourself, does reacting to a piece of FUD or FOMO information bring you closer to or distance you from your trading goals? This perspective can help you stay focused and less likely to be swayed by market sentiments.

Craft a Comprehensive Trading Strategy

Before embarking on any trading journey, it’s pivotal to have a detailed strategy in place. This typically includes predefined entry and exit points, stop-loss limits, and an overall investment budget. With such a framework, you become less susceptible to impulsive decisions that might be triggered by FUD.

Develop a Mindset of Emotional Discipline

Emotional disturbances are a trader’s worst enemy. Embrace a mindset of emotional discipline, where you make decisions based on logic and your trading strategy, not on the wave of emotions spurred by market rumors or dramatic news.

Exercise Skepticism and Caution

Not all information should be trusted, especially in the digital age characterized by the rapid dissemination of news, both accurate and otherwise. Always verify the source of the information and consider its credibility.

Invest in Knowledge

Learn about the blockchain technology underlying cryptocurrencies. The more you learn about the functioning of the crypto market and the factors that influence it, the better equipped you are to decipher FUD from genuine news.

By following these steps, traders can successfully identify FUD, prevent themselves from acting on misinformation, and make more sound investment decisions. Navigating the crypto space can be arduous, especially with the likelihood of encountering FUD. However, with the right approach, traders can turn these challenges into opportunities for growth and profitability.

Safeguarding Against FUD: Essential Steps for Cryptocurrency Traders

Navigating the bustling landscape of cryptocurrency trading can often seem daunting. A crucial part of staying afloat amidst the turbulent wave of market fluctuations is knowing how to discriminate valuable information from FUD. What’s more, traders must maintain a steady and patient approach throughout their journey.

Be Thoroughly Informed; Verify Your Sources

Being well-informed is a non-negotiable for any trader in the crypto market, particularly for those involved in day trading. Regularly catching up with the latest developments, trends, and events in the crypto world can put you in a much stronger position to make sound trading decisions.

However, it’s equally important to verify the sources of your information. Cryptocurrency, being an increasingly popular and lucrative field, has its fair share of misinformation and unverified news making rounds on various platforms. Ensure that the sources of your information are reliable and trustworthy.

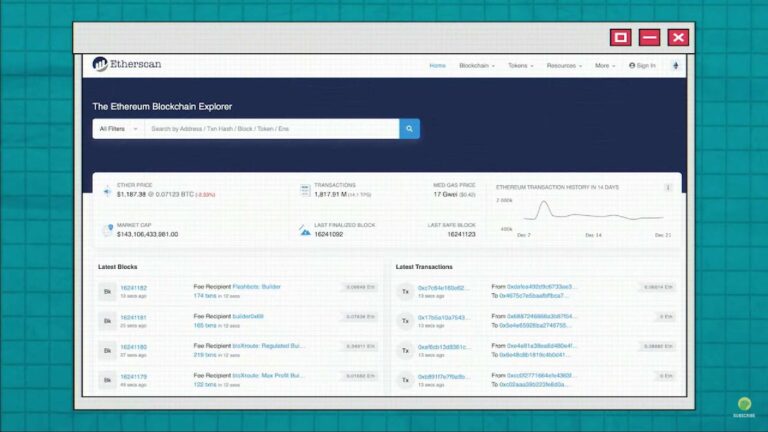

For instance, news websites and platforms dedicated to covering cryptocurrency and blockchain news, reputable financial news outlets, and official announcements from blockchain projects and crypto companies are generally considered reliable sources. It’s advisable to cross-check any suspicious piece of information with multiple sources before acting upon it.

Cultivate Patience and Maintain Consistency

The allure of quick financial gains might seem tempting, but it’s critical to remember that cryptocurrency trading is not a get-rich-quick scheme. It requires patience, consistency, and a thorough understanding of market trends and the underpinning technology.

While executing trades, ensure you’re not getting carried away with the momentum of the market or the frenzy of other traders. Stick to your trading strategy and don’t let FUD or FOMO influence your decisions.

Here are some tips to help maintain patience and consistency in crypto trading:

- Stick to Your Trading Plan: Your trading plan is your blueprint. Stick to it, even when the market behaves unexpectedly;

- Avoid Overtrading: Trading too frequently can lead to rash decisions and unnecessary losses. Trade smart, not often;

- Detach Emotionally: Don’t let a series of wins make you overconfident or a series of losses make you fearful. Stay emotionally detached from the trading process;

- Continuous Learning: The crypto market is continuously evolving. Keep learning and updating your knowledge about market trends and new trading strategies.

By staying well-informed, verifying your sources, and cultivating patience and consistency, traders can effectively safeguard themselves against the detrimental impacts of FUD and make the most of their trading journey.

Steering Clear of FUD in Cryptocurrency Trading

While it might sound challenging to navigate through the murky waters of FUD, a trader can easily overcome such obstacles by adhering to a specific set of guidelines and by sourcing their information judiciously.

Trust Reliable News Sources, Not Just Quick Tips

While social media platforms like Twitter can help obtain quick updates and tips, they also come with the risk of misinformation or intentional manipulation. A savvy trader should always consider the potential motives behind a piece of information before letting it influence their decisions.

Do Your Own Due Diligence

It’s equally important to carry out thorough research when considering investment in a new project. This includes studying the project’s whitepaper, understanding the problem it aims to solve, evaluating the technical competencies of its team, and scrutinizing the project’s roadmap and objectives. In other words, conducting comprehensive due diligence can safeguard a trader from falling prey to FUD.

Embrace Responsible Financial Behavior

Engaging in the crypto market can indeed provide lucrative opportunities, but it’s equally crucial to approach this arena with a sense of responsibility. Observing market trends from a critical perspective, making informed trading decisions, and exercising sound financial management are key to fostering a healthy and profitable trading journey.

Here are a few tips for responsible trading:

- Avoid Over-exposure: Diversify your portfolio and avoid putting all your eggs in one basket. Over-exposure to a single asset or a type of asset can increase your risk levels;

- Stick to the Plan: Stick to your pre-determined trading plan, goals, and risk-reward ratio even when the market is volatile;

- Have a Risk Management Plan: Always have a risk management plan in place. Knowing how much you’re willing to risk on each trade and setting stop-loss orders accordingly can help mitigate potential losses.

By following these guidelines, cryptocurrency traders can not only steer clear of FUD but also ensure they are trading responsibly, paving the way for sustainable success in the crypto market.

Conclusion

In summary, while FUD may always be a part of the crypto landscape, you have the tools and knowledge to navigate it successfully. By conducting thorough research, staying informed, maintaining emotional resilience, diversifying your portfolio, and critically evaluating information, you can reduce the impact of FUD and make more informed decisions in the world of cryptocurrencies.