In the world of decentralised finance (DeFi), yield farming has become a popular way to earn passive income. For many crypto enthusiasts, it represents an opportunity to make their digital assets work for them, generating returns far beyond those offered by traditional banking. However, while the potential rewards are enticing, there are also significant risks involved. This guide will help you understand the basics, including the risks, rewards, and best practices to get started safely.

What is Yield Farming?

Yield farming is a process where cryptocurrency holders earn rewards by lending or staking their digital assets in decentralised platforms. It’s about providing liquidity to DeFi protocols, such as lending pools or decentralised exchanges, in return for interest or governance tokens. The returns offered by yield farming can be substantial, sometimes reaching double or even triple digits annually, depending on the platform and market conditions.

When you participate in yield farming, you become a liquidity provider (LP), depositing your tokens into a smart contract that creates liquidity pools. In return, you earn a portion of the transaction fees or additional tokens as a reward.

Popular DeFi platforms like Uniswap, Aave, and Compound have all facilitated yield farming, making it an attractive option for users seeking to earn passive income while retaining exposure to cryptocurrency markets.

Rewards and Potential Returns

Yield farming can provide lucrative rewards. The returns are typically expressed as an annual percentage yield (APY), which can vary depending on factors such as market demand, the amount of liquidity provided, and the specific DeFi protocol used. Many platforms incentivise users by offering governance tokens as a reward, adding an additional layer of potential profit.

These rewards are attractive, particularly when traditional interest rates are low, but they come with inherent risks. High APYs often indicate high risk, which may include smart contract vulnerabilities, impermanent loss, or market fluctuations. For those who understand the landscape and take appropriate precautions, yield farming can enhance their crypto portfolio. Yield farming has also inspired cross-platform experiments like liquidity mining, allowing users to explore a variety of financial products while collecting rewards, similar to how roulette online free offers excitement in digital gaming.

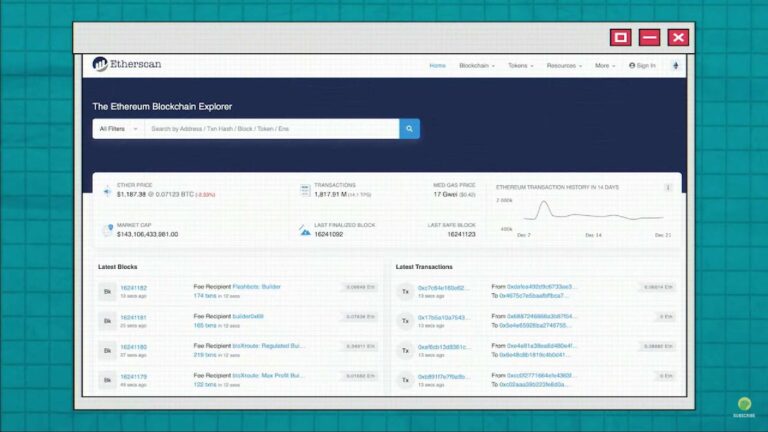

Yield farmers may take the tokens they receive as rewards and re-invest them in new liquidity pools, compounding their returns. However, such strategies require careful planning and an understanding of gas fees, particularly on blockchains like Ethereum, where transaction costs can be high and quickly erode profits.

Risks of Yield Farming

While yield farming presents an opportunity for potentially high rewards, it also involves considerable risks.

Smart Contract Vulnerabilities

Smart contracts are the backbone of yield farming. These self-executing contracts eliminate the need for intermediaries, allowing transactions to occur automatically. However, if there are vulnerabilities in the code, your funds could be at risk. Many DeFi protocols have been hacked in the past, leading to losses for liquidity providers.

To mitigate this risk, it’s important to choose established platforms that have undergone rigorous code audits. While newer platforms may offer higher returns, they often carry greater risk due to their untested infrastructure.

Impermanent Loss

Impermanent loss affects liquidity providers when the price of their staked tokens changes compared to when they were initially deposited. This occurs due to the automated market maker (AMM) mechanism of liquidity pools, which constantly rebalances the ratio of tokens to facilitate trading. Depending on the price change, impermanent loss can result in significant losses, sometimes outweighing farming rewards.

Yield farmers can reduce the impact of impermanent loss by choosing assets that are less volatile or closely correlated in value.

Market Risks and Gas Fees

Another major risk is the volatility of the cryptocurrency market itself. The value of tokens used for yield farming can fluctuate wildly, leading to potential losses if prices drop. On top of this, gas fees, particularly on the Ethereum network, can be prohibitive for smaller investors, making yield farming profitable only when a significant amount is staked.

For those navigating the challenges of DeFi, having a reliable payment method is crucial. You might want to consider the Sofort casino payment option, which allows for swift and secure transactions, making it easier to engage with DeFi platforms and enhance your yield farming strategies.

Best Practices for Yield Farming

For beginners interested in yield farming, there are several best practices that can help manage the risks.

- Start Small and Diversify: Begin with a small amount of capital that you can afford to lose. Diversification is also key; spreading your assets across different platforms or pools can reduce the risk associated with any one protocol.

- Do Your Research: Take the time to understand how each platform works. Check for audits, look into the team behind the project, and learn about the risks specific to that platform.

- Monitor Gas Fees: Particularly for those using Ethereum-based platforms, gas fees can quickly erode profits. Track gas prices and time your transactions to avoid peak hours, or consider using lower-cost blockchain networks like Binance Smart Chain or Polygon.

- Manage Your Liquidity Pools: Monitor your investments regularly. Keep track of price changes and potential impermanent losses. Some yield farmers may need to rebalance their positions or withdraw liquidity if market conditions become unfavourable.

Conclusion

Yield farming is an exciting and potentially rewarding aspect of DeFi, providing opportunities to earn passive income and engage with the crypto economy. However, it comes with significant risks that must be approached cautiously. By understanding the dynamics of liquidity pools, managing risks associated with smart contracts and impermanent losses, and following best practices, yield farmers can increase their chances of success.

The key to yield farming, as with any investment strategy, is to stay informed and manage your risk. The rewards are out there, but they are accompanied by real risks that must not be ignored.